Pioneering the Future of BFSI with Data-Driven Clarity: Empowering Financial Leaders to Lead the Digital Frontier

Architecting the Cognitive Enterprise

Intelligent Financial Crime Management (Oracle FCCM + AI)

- The AI Edge: We deploy Graph Analytics and Machine Learning models that detect complex money laundering networks in real-time, reducing false positives by up to 60% and identifying "mule" accounts before they transact.

- Outcome: A fortified perimeter and significantly lower operational costs for compliance teams.

The "Continuous Close" & Predictive Finance (Oracle Fusion ERP)

- The AI Edge: Using Oracle’s Intelligent Process Automation (IPA), we automate up to 96% of reconciliations. Generative AI assistants allow CFOs to ask natural language questions (e.g., "Predict our liquidity position for Q3 based on current market volatility") and get instant, charted answers.

- Outcome: A finance team that acts as a strategic advisor, not just a scorekeeper.

Hyper-Personalized Customer Experience (Oracle CX + GenAI)

- The AI Edge: We build "Financial Health Assistants" that analyze spending habits to nudge customers with hyper-relevant offers (e.g., "You've hit your savings goal; here is a high-yield CD offer optimized for you") rather than generic spam.

- Outcome: Increased Customer Lifetime Value (CLV) and "sticky" digital relationships.

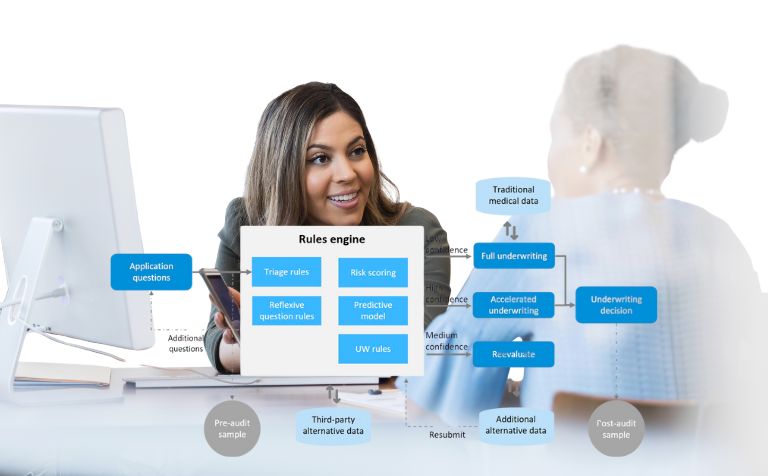

Algorithmic Underwriting & Claims (Oracle Insurance)

- The AI Edge: We integrate IoT data streams (telematics, smart home sensors) directly into the Oracle policy admin system. Computer Vision algorithms analyze accident photos to auto-adjudicate simple claims in seconds, not weeks.

- Outcome: A seamless "touchless" claims experience that delights customers and reduces settlement costs.

Navigating the Risk-Reward Paradox

Financial leaders are currently balancing three critical pressure points:

The "AI vs. AI" Security War

Fraudsters are now using Generative AI to create deepfakes and sophisticated phishing attacks. Traditional rule-based fraud detection systems yield too many false positives and cannot keep pace.

The Regulatory Tsunami

With regulations like DORA (Digital Operational Resilience Act), Basel IV, and ESG reporting mandates, the cost of compliance is skyrocketing. Data silos make real-time reporting nearly impossible.

The "Spotify-ification" of Banking

Customers expect hyper-personalized, instant financial advice. They demand a bank that "knows" them, not just one that stores their money. Legacy mainframes prevent this level of real-time data agility.

Operational Blind Spots

In insurance, underwriting leakage and slow claims processing are eroding combined ratios. Insurers lack the real-time IoT data integration needed to shift from "repair and replace" to "predict and prevent".